Vancouver, British Columbia – TheNewswire – May 31, 2021 – Lakewood Exploration Inc. (CSE:LWD) (CNSX:LWD.CN) (OTC:LWDEF) (the "Company" or "Lakewood") is pleased to announce that it has entered into a share exchange agreement dated effective May 31, 2021 among the Company, Silver Hammer Mining Corp. (“Silver Hammer”) and the shareholders of Silver Hammer (the “Definitive Agreement”), pursuant to which, subject to regulatory approval, the Company will acquire 100% of the issued and outstanding shares of Silver Hammer (the “Proposed Transaction”). Silver Hammer owns a 100% interest in a prospective silver-zinc project located in Idaho, United States, being the Silver Strand Project.

The Silver Strand Project

-

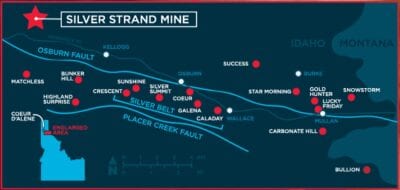

– The Silver Strand Mine has a 5.5km strike length in the Coeur d’ Alene mining district in Idaho.

– Located in North Idaho’s Silver Valley along Interstate 90.

– The district is known for its depth potential with numerous deposits and has produced over 1.2 billion ounces of silver.

The Proposed Transaction

Pursuant to the terms of the Definitive Agreement, upon the date of closing (the “Closing Date”) of the Proposed Transaction, Lakewood will acquire 100% of the issued and outstanding securities of Silver Hammer in consideration for the issuance of 7,800,000 common shares of the Company (the “Payment Shares”) pro rata to shareholders of Silver Hammer, which are expected to be equal to approximately 41% of the shares of the Company upon closing of the Proposed Transaction (excluding any securities issued in the Offering, as described below). In addition, the Company will issue 500,000 common shares to an arm’s length third party finder in connection with the Proposed Transaction (the “Finders’ Shares”). The Payment Shares and Finders’ Shares will be subject to certain voluntary hold periods, with 25% of the Payment Shares released on the date that is 3 months following the Closing Date and an additional 25% released every 3 months thereafter until all Payment Shares have been released.

The Proposed Transaction remains subject to certain closing conditions including, without limitation, (a) the receipt by the Company of all necessary corporate and regulatory approvals; and (b) each party’s representations and warranties in the Definitive Agreement being true and correct in all aspects as of the Closing Date, and each party meeting its terms and conditions and completing its covenants and obligations as contained therein. There can be no guarantees that the Proposed Transaction will be completed as contemplated or at all. The Proposed Transaction is anticipated to close on or before June 30, 2021.

There will be no changes to the Company’s board or management in connection with the Proposed Transaction.

The Private Placement

The Company is also pleased to announce that it is conducting a non-brokered private placement financing of up to 14,000,000 units of the Company (collectively, the "Units") at a price of $0.25 per Unit for aggregate gross proceeds of up to $3,500,000 (the "Offering"). Each Unit will consist of one common share of the Company (each, a "Common Share") and one-half of one common share purchase warrant (each whole warrant, a "Warrant"). Each Warrant will entitle the holder thereof to acquire, on payment of $0.50 to the Company, one common share of the Company (each, a "Warrant Share"), subject to adjustment in certain circumstances, for a period of 24 months from the closing date. The Company may accelerate the expiry of the Warrants in the event that for any ten consecutive trading days the daily volume weighted average trading price of the Common Shares is greater than $0.60.

Proceeds from the Offering are expected to be used for exploration activities on the Company’s Lacy Property Gold Project, completion of the Proposed Transaction and exploration on Silver Hammer’s Silver Strand Project and for general working capital purposes. The Company may pay finder’s fees and warrants on the Offering within the amounts permitted by the policies of the Canadian Securities Exchange.

All securities issued pursuant to the Offering will be subject to a four-month plus one day hold period from the closing date. The Company may pay finder’s fees and/or commissions to eligible persons in connection with the Offering in accordance with applicable securities laws and the policies of the Canadian Securities Exchange.

FOR FURTHER INFORMATION PLEASE CONTACT: Michael Dake, Chief Executive Officer and Corporate Secretary, at 200 – 551 Howe Street Vancouver, British Columbia V6C 2C2, email: [email protected]

The CSE does not accept responsibility for the adequacy or accuracy of this release.

The Canadian Securities Exchange has not in any way passed upon the merits of the Proposed Transaction and has neither approved nor disapproved the contents of this press release.

The securities to be issued in connection with the Proposed Transaction and Offering have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the "1933 Act"), or under any state securities laws, and may not be offered or sold, directly or indirectly, or delivered within the United States or to, or for the account or benefit of, U.S. persons (as defined in Regulation S under the 1933 Act) absent registration or an applicable exemption from the registration requirements. This news release does not constitute an offer to sell or a solicitation to buy such securities in the United States.

This press release includes "forward-looking information" that is subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company. Forward-looking statements may include but are not limited to, statements relating to the Company’s ability to complete the Proposed Transaction on the terms announced or at all, the Company’s ability to complete the Offering on the terms announced or at all and the Company’s use of proceeds. Such statements are subject to all of the risks and uncertainties normally incident to such events. Investors are cautioned that any such statements are not guarantees of future events and that actual events or developments may differ materially from those projected in the forward-looking statements. Such forward-looking statements represent management’s best judgment based on information currently available.

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Copyright (c) 2021 TheNewswire – All rights reserved.